NY Times:Rohingya migrants swam to collect food supplies dropped by a Thai Army helicopter in the Andaman Sea. Credit Christophe Archambault/Agence France-Presse — Getty Images

Adrift in the Andaman Sea are hundreds of thousands of people in the verge of death due to hunger, thirst and victims of human cruelty.

They are the Rohingyas, a Muslim ethnic group mainly living in Myanmar. It is estimated that they number some 800,000 and comprise 80 to 90 percent of the state of Rakhine.

Boatloads of them have fled Myanmar where they are being persecuted. Myanmar does not consider them its citizens. History accounts say they migrated from Bengal during the 1700s during the British rule. Although some scholars say they are indigenous to the state of Rakhine.

BBC’s primer on Rohingya is most helpful in understanding the humanitarian crisis that the Association of Southeast Asian Nations or ASEAN is hard put to confront.

Why are they fleeing Myanmar?

The BBC primer explains that “Successive Myanmar governments have been introducing policies to repress the Rohingya since the 1960s.They argue that Rohingyas are not a genuine ethnic group but Bengali migrants who represent a divisive leftover from colonial times.

They are denied basic services and their movements are severely restricted. The repression of the Rohingyas has gradually intensified since the process of reforms introduced by President Thein Sein in 2011.

The oppression they suffer there is so severe “that they feel they have no option but to leave”, Bangkok-based Rohingya expert Chris Lewa told the BBC.

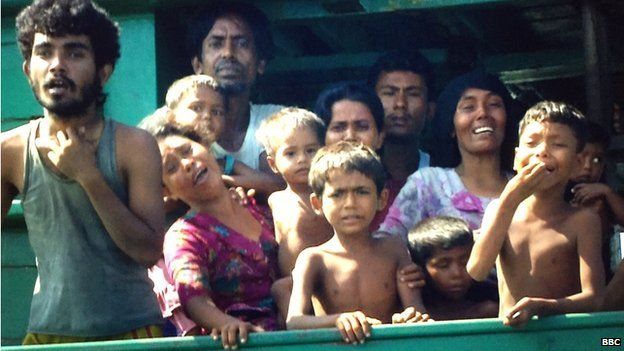

Crying out for help from the sea. BBC

So inflammatory is the Rohingya issue in Myanmar that democracy icon Aung San Suu Kyi, who is now a member of the parliament after years of imprisonment, has not been heard on her views about the persecution of the Rohingyas.

What’s the attitude of ASEAN countries where the boatloads of Rohingyas have tried to seek refuge to?

From BBC’s primer:

Thailand: Its Navy says that it has given aid to migrant boats in its waters, and it has indicated that it may be prepared to allow refugee camps on its shores. But it does not want permanent settlers, and few Rohingyas want to settle in the country even if the alternative is to remain on cramped boats.

Malaysia: This is the choice of destination for most Rohingya travellers, especially because it is predominantly Muslim and short of unskilled labourers. But Malaysia has made clear that it will not accept boatloads of migrants and has ordered its navy to repel them.

Bangladesh: For the last 20 years has been subjected to an influx of Rohingyas, sometimes allowing them to live in camps on its south-eastern border and sometimes sending them back to Myanmar. It is estimated that there are currently about 200,000 Rohingyas living in refugee camps, many in squalid conditions.

Indonesia: Like Malaysia is a Muslim country and like Malaysia has made clear that the Rohingyas are not welcome, with its navy turning away boatloads of migrants. A group of migrants who made it ashore in early May may be expelled, the government has warned.

The attitude of Indonesia, Malaysia and Thailand on the Rohingya’s is appalling considering that just two weeks ago,ASEAN Leaders (including Myanmar) in their 26th summit signed a “Kuala Lumpur Declaration on a People-Oriented, People-Centred ASEAN” agreeing to do the following:

“Strengthen efforts to build a people-oriented, people-centred and socially responsible socio-cultural community with a view to achieving enduring solidarity and unity among the ASEAN peoples by instilling a shared appreciation of cultural diversity as well as promoting the well-being and welfare of the peoples;

“Promote and protect the rights of women, children, youth and elderly persons as well as those of migrant workers, indigenous peoples, persons with disabilities, ethnic minority groups, people in vulnerable situations and marginalised groups, and promote their interests and welfare in ASEAN’s future agenda including through the ASEAN Community’s Post-2015 Vision and its attendant documents;

“Alleviate poverty and narrow the development gap by increasing access to basic needs and work towards achieving adequate standards of living in line with our global commitment on poverty eradication;

“Ensure our people’s access to clean water, clean air, basic healthcare and other social services so that they may lead healthy and productive lives and thereby contribute to the ASEAN Community.”

The Philippines has not made a statement on the Rohingya’s plight.

But there is one Filipino who has stood up for the Rohinyas. Former Agrarian Reform Secretary Ernesto Garilao made a personal appeal to President Aquino in Facebook:

“Dear Mr. President, Can we not give them temporary shelter; as we did with the Jews before the war; and the Vietnamese after the Vietnam war. The more important thing is that they don’t die at sea; as they would if no one left a finger. Mr. President, if the face of the circumstance, it is the right thing to do. It is at our Asean backyard.”

Nothing has been heard from Malacañang.

We are part of the community of man. Our many problems should not be an excuse to be oblivious of what is happening beyond our shores.

Our sense of humanity is diminished if we close our eyes and pretend the Rohingya humanitarian crisis is not happening and does not concern us.